IMO adopts revised GHG strategy – What can the industry expect?

July 20, 2023

On July 3-7, the International Maritime Organization (IMO) held its 80th meeting on Marine Environment Protection. The meeting was attributed high importance for tackling climate change in an industry that is currently responsible for 2-3% of global greenhouse gas emissions. The decisions made on IMO level will have implications for all stakeholders in the industry and will impact shipowners in the coming years. We have taken a closer look at the outcomes and asked Simon Bergulf, Group Representative Europe Public and Regulatory Affairs & Head of Energy Transition and Rasmus Philipsen, Senior Advisor Public and Regulatory Affairs from A.P Møller Maersk, about their views and the significance of the agreement. They both participated in the IMO meeting in London and have shared their impressions with us.

What has been decided?

The IMO has adopted a revised greenhouse gas emissions reduction strategy for international shipping. After several years of negotiations, all member states agreed in the final voting round on reaching net-zero emissions “by, or close to 2050”. This significantly strengthens the previous targets of halving the emissions of 50% until 2050.

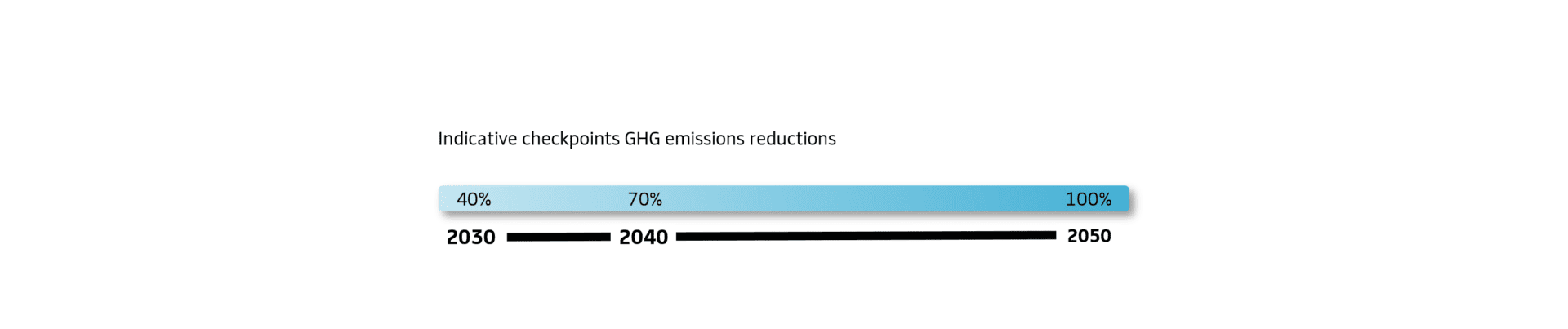

The strategy aims at phasing out GHG emissions “as soon as possible”, with indicative checkpoints of a 40% reduction in 2030, and a 70% reduction in 2040, compared to 2008 levels. Ultimately, the enhanced targets aim at phasing out all GHG emissions by 2050. As realising these targets largely depends on the use of zero or near zero emissions technologies and fuels, the strategy also includes the ambition to reach a minimum 5% of clean energy used by 2030.

Major achievement?

Despite some criticism from NGO’s, Bergulf and Philipsen consider the agreement a breakthrough on IMO level, where decisions are being made via consensus voting from all member states. “There has been a lot of criticism that the IMO has been very slow to act, and we wanted them to be faster. So, this is a major achievement.” According to Bergulf and Philipsen, the strategy is a strong signal for the industry and will have significant impact on investment decisions in the coming years bringing increased confidence in profitability of investments in the entire chain of alternative fuels.

“We need to start now, and we need to build up the renewables now."

For European shipowners, some elements of the IMO strategy may not come as a surprise, as the target of reaching a Global Fuel Standard in 2025 has similarities with the FuelEU Maritime legislation. The FuelEU Maritime, which was agreed in early 2023, aims at having 6% of green fuels in the fuel mix by 2030, compared to a target of 5% set by the IMO. On the realisation of these targets, Bergulf states that the production and availability of the green fuels remains the biggest challenge for shipowners. Approximately 800,000 tonnes of methanol are needed alone for Maersk’s dual-engine container vessels, and the production requires increased investments as well as facilitated processes from the legislator’s side. “We need to start now, and we need to build up the renewables now.”

However, Philipsen points out the importance of having both measures, the green fuels push and an operational energy efficiency push, which encourages considerations on improving efficiency in how vessels are being operated. On EU level, the EU ETS (read more about the EU ETS here), will come into effect in 2024 and a similar system will seemingly be developed on IMO level, implementing a carbon emission pricing mechanism on a global scale in the years to come. All member states agreed on the introduction of a carbon levy, which Bergulf also considers as a major achievement, as many member states have, prior to this meeting, been opposed to such a system.

What can the industry expect now?

The industry will experience substantial changes in the coming years, with the EU ETS in 2024 and the FuelEU Maritime coming into effect in 2025, and the targets of the IMO on the horizon. Questions on the costs and benefits will require strategic considerations from shipowners, operators, and charterers. Bergulf and Philipsen further state the inevitable fact that the legislation will also come with additional costs, which will ultimately be passed on to the consumer.'

" It is not a reduction game, we anticipate a complete transition to new technologies."

Consequences for financial markets and ship financing are also to be expected. “Investing in fossil fuel vessels will become less attractive, simply because of the changes on what you are allowed to do, so if you are buying fossil fuel vessels today, how attractive are they going to be in 10 or 20 years?” Long-term strategic business considerations should go beyond improving energy efficiency and plan investing in net-zero technologies. Philipsen states that at Maersk, they believe that it is not a reduction game, but anticipate a complete transition to new technologies. “It is still an open question with what technologies and fuels we will get there, but in container shipping we are aligned with our competitors on the mindset that we need to change, and act now.”

What has been emphasised again with the agreement in London is the general direction in which the industry is heading. “It is getting more difficult and expensive to stay on the fence” as Bergulf states. Therefore, the time for considerations for existing fleets and newbuilds is now, so the ambitious targets on decarbonising the industry in the next years can be met.

We would like to thank Simon Bergulf and Rasmus Hald Philipsen for their input on the topic.

As stated, the energy transition of shipping requires a strategy on adapting existing fleets. At MB Shipbrokers, our Energy Transition team is ready to assist you. Please reach us at: transition@mbshipbrokers.com.

Olof Klintholm

Head of Energy Transition

Copenhagen office

+45 3123 8683

okl@mbshipbrokers.com