A Growing Fleet on Paper - But Who’s Really Trading?

Fleet Development and Aging - Crude and Product Tankers

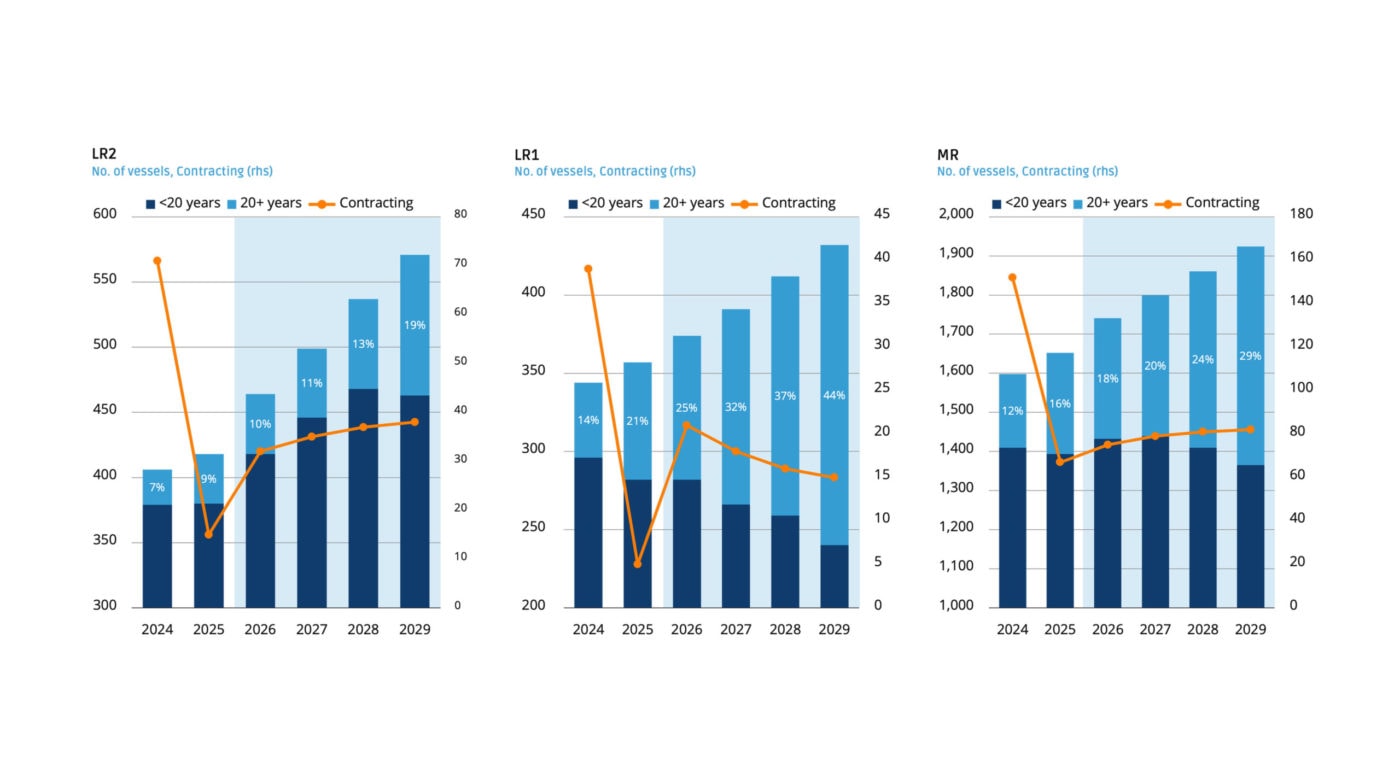

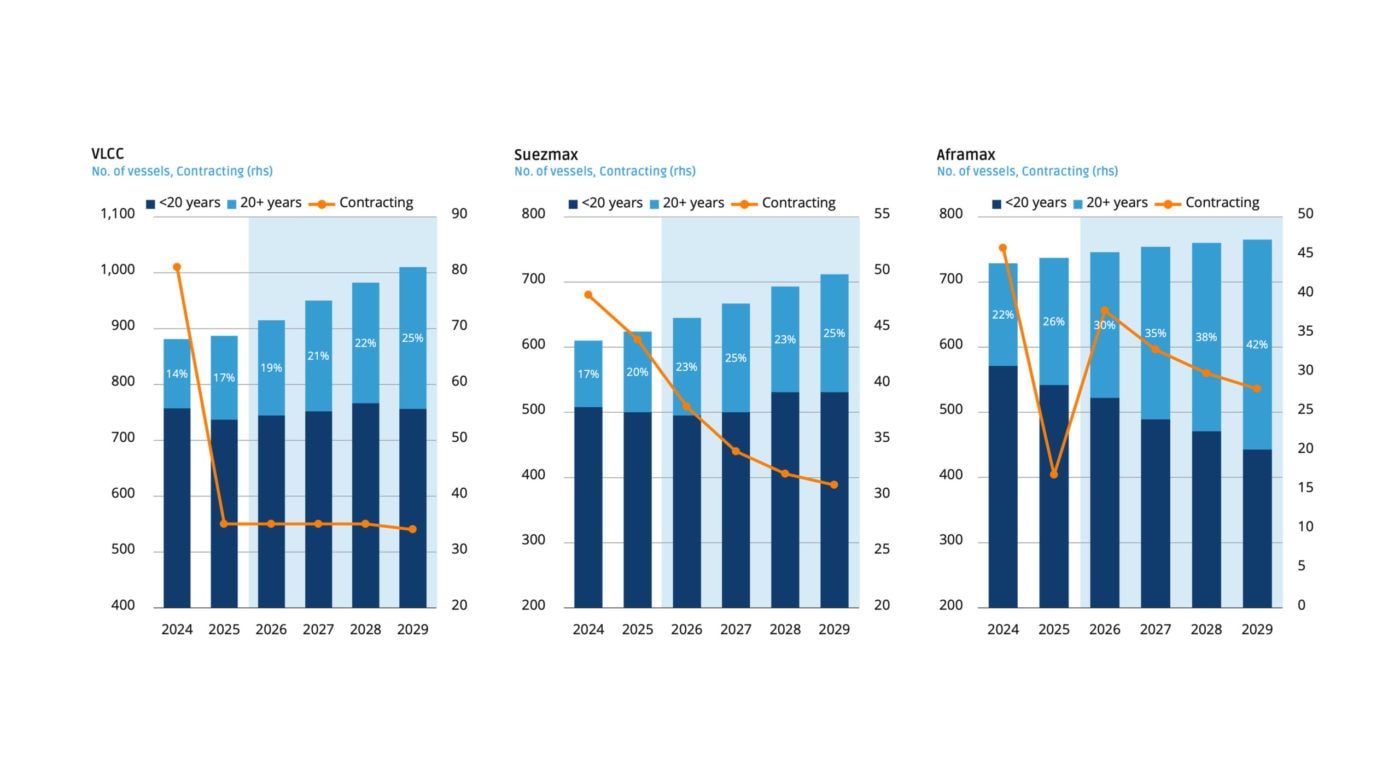

At first glance, the global tanker fleet seems to be expanding at a healthy pace. Charts are rising, orderbooks are active, and delivery forecasts point to substantial additions through 2026 and beyond. For both the crude and product segments, the picture painted by headline fleet growth figures is one of vitality and continued strength. Owners, analysts, and market watchers alike might be tempted to conclude that the market is well-supplied - and potentially heading toward oversaturation.

Aging Fleet, Shrinking Utility

Yet a closer look reveals a structural imbalance: an aging fleet that is increasingly unfit for modern trade. The proportion of tankers over 20 years old continues to rise, and while these vessels remain technically on the water, their commercial utility is rapidly fading. Recent utilization data shows a sharp drop-off in activity for tankers past their 15th birthday, with near-complete retirement from active service by year 20. This is particularly stark in the product segment: less than 2% of LR1 and LR2 liftings come from vessels older than 20 years, despite them comprising 22% and 9% of their respective fleets.

The Crude Segment: A Hidden Tightness

The discrepancy between fleet presence and trading relevance is even more pronounced in the crude segment. Over 55% of Aframaxes, 42% of Suezmaxes, and 39% of VLCCs are now more than 15 years old. Yet their contribution to liftings is far lower than their share of the fleet would suggest. The result: a fleet that looks larger on paper than it truly is in practice.

Future Deliveries vs. Imminent Scrapping

Forecasts for deliveries and contracting through 2029 reinforce this mismatch. While deliveries are expected to surge - particularly in the VLCC and Suezmax classes - the pace may not be fast enough to counterbalance the aging curve and the deferred wave of scrapping. Scrapping, after years of minimal activity, is projected to increase somewhat from 2026 onward. Until then, these older vessels continue to inflate supply figures without contributing meaningfully to shipping capacity.

Rethinking ‘Fleet Growth’

This challenges us to rethink what we count as true capacity. Should vessels too old to trade be considered part of active supply? Are current orderbooks sufficient to replace aging tonnage - not just in number, but in relevance? As fleet renewal lags behind fleet aging, the tanker market may be facing not an oversupply, but a hidden tightening.

For further information please contact:

Cecilie Raknes

Senior Research Analyst, Tanker Research

Copenhagen office

+45 33 44 14 86 / +45 53 78 91 26

research.tanker@mbshipbrokers.com

Lars Olsen

Senior Director, Tanker Chartering

Copenhagen office

+45 33 44 16 15 / +45 31 77 33 93

tankers.cph@mbshipbrokers.com