Petrochemical Feedstock Dynamics: LPG vs. Naphtha

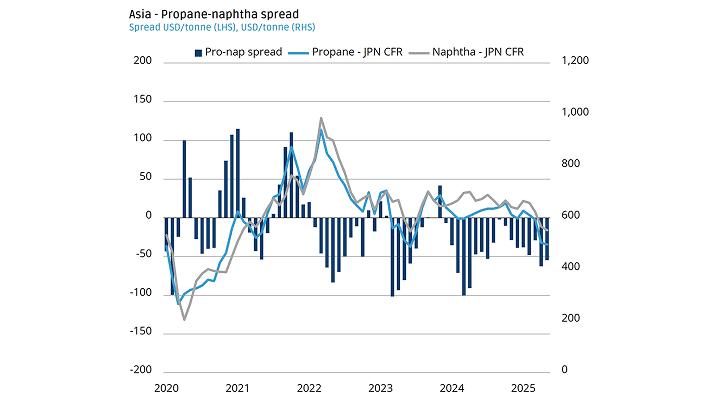

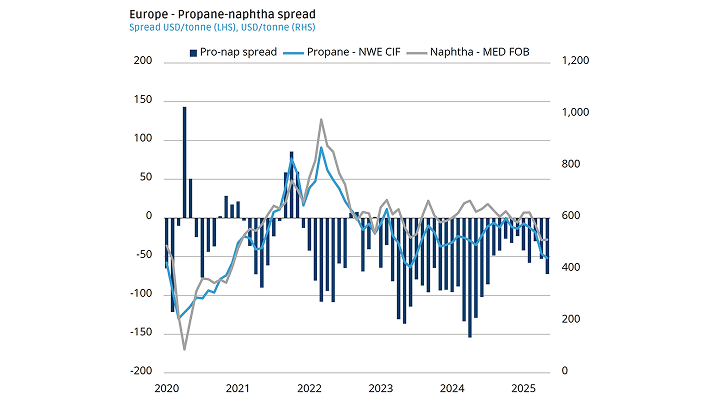

While mixed-feed crackers offer flexibility across petrochemical feedstocks, the optimal feed choice remains a function of evolving price spreads and regional supply dynamics. With the pro-nap spread narrowing toward historical switching levels, the balance of economic advantage could shift again.

Historical Price Development

- Propane traditionally gains favour over naphtha when its price is $50/tonne lower.

- Since the onset of the Russia/Ukraine conflict, the spread has been consistently wide in Europe, with propane maintaining a significant discount.

Impact of EU Sanctions

- EU's ban on Russian CPP exports in December 2022 triggered a sharp decline in naphtha flows to Europe.

- The European naphtha market has struggled to recover due to sanctions and uncompetitive pricing dynamics.

Substitution Challenges

- While LPG volumes to Europe have been readily supplied from across the Atlantic, naphtha replacement remained constrained.

- Baltic-sourced naphtha has been difficult to substitute, contributing to a prolonged supply constraint to Europe.

Growing Supply

- Despite the extreme volatility, the pro-nap spread in both Europe and Asia have started trading closer to the $50/tonne switching threshold offering arbitrage opportunities.

- With both US and Middle Eastern naphtha exports on the rise, naphtha could start gaining favour as a preferred feedstock in both Europe and Asia.